News

Outcrop Silver Intercepts 1.54 Metres at 1,067 Grams Equivalent Silver per Tonne in New Naranjos Shoot Expanding Resource Potential at Santa Ana

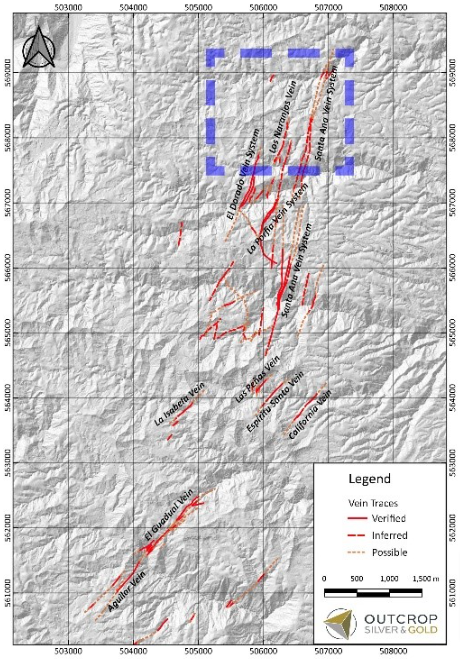

Outcrop Silver & Gold Corporation (TSXV:OCG, OTCQX:OCGSF, DE:MRG1) (“Outcrop”) is pleased to announce the results from six core holes designed to test the Naranjos structure on its 100% owned Santa Ana high-grades silver project in Colombia. The Naranjos vein is a parallel vein between the Santa Ana vein system 350 metres to the east, and the Eldorado vein system 350 metres to the west. Naranjos commonly hosts native silver and silver-rich electrum. Thirteen drill holes have been completed to date. Six returned high-grade assays and four holes have assays pending. Naranjo is open in all directions.

Thirteen shoots are now recognized on the property. All thirteen shoots are open at depth and their cumulative strike provides over 2.8 kilometres of potential resource area to include in the maiden compliant resource to be reported before the end of 2022.

Highlights

- With Naranjos, thirteen shoots have drill definition on Santa Ana. Numerous targets with high-grade silver equivalent assays over kilometres of strike suggest additional shoots will be defined by drilling in the near term.

- DH244 in Naranjos returned 1.54 metres at 1,067 grams equivalent silver per tonne.

- DH241 in Naranjos returned 0.61 metres at 1,562 grams equivalent silver per tonne.

- Naranjos is a significant step out to the north and indicates high-grade mineralization is likely to continue in that direction on two or more vein zones.

- Naranjo extends for at least 150 metres along strike and 150 metres to depth and is open in all directions.

- The cumulative strike of the thirteen currently drill-defined shoots provides over 2.8 kilometres to the potential resource area.

“Once more, the Santa Ana project shows its true potential as a premium silver asset in Colombia,” comments Guillermo Hernandez, Vice President of Exploration. “As we continue with the definition of new high-grade shoots that show consistent high-grade intercepts, we are very excited to soon publish our first compliant resource estimation for Santa Ana.”

“The success rate on targets is extremely encouraging at Santa Ana,” comments Joe Hebert, Chief Executive Officer. Target generation continues to keep pace ahead of drilling with three core rigs. The team continues to advance the robust four-kilometre-long Aguilar vein system, a south extension of Las Maras vein system with its extremely high grades in drilling, and notably, the excellent potential at Frias ten kilometres south from Aguilar. The Frias mine, which is 100% owned by Outcrop, has reported production of 7.8 million ounces of silver at 1.3-kilogram Ag/t recovered grade. With high-grade outcropping mineralization a characteristic of all targets, success is expected in all these areas.”

Naranjos

The Naranjos target is 350 metres west of the original Santa Ana vein system (Map 2). Surface prospecting before drilling of the Naranjos vein provided samples with values up to 2,224 grams equivalent silver per tonne (see news release June 2, 2022), providing an excellent expression of Naranjo’s potential before drilling.

The Naranjos vein is characterized as a quartz vein and associated shear zone (Figure 1) that dips sub-vertically to the west. The quartz vein shows textures indicating brittle-ductile deformation, indicating a mesothermal stage of mineralization. Silver mineralization includes pyrargyrite (silver-sulfosalt) and native silver (Figure 2), and electrum (Figure 4). Locally massive pyrite, galena and sphalerite combined can make up to 20% of the vein.

Metal prices used for equivalent calculations were US$1,827/oz for gold, US$21.24/oz for silver, US$0.90/lb for lead and US$1.56/lb for zinc.

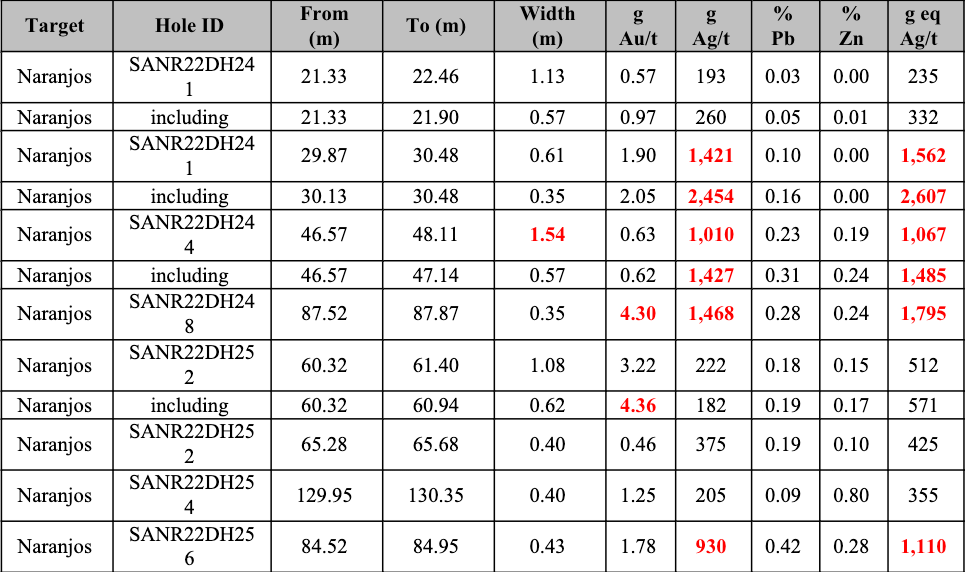

Table 1. Significant drill assays from the Naranjos Target.

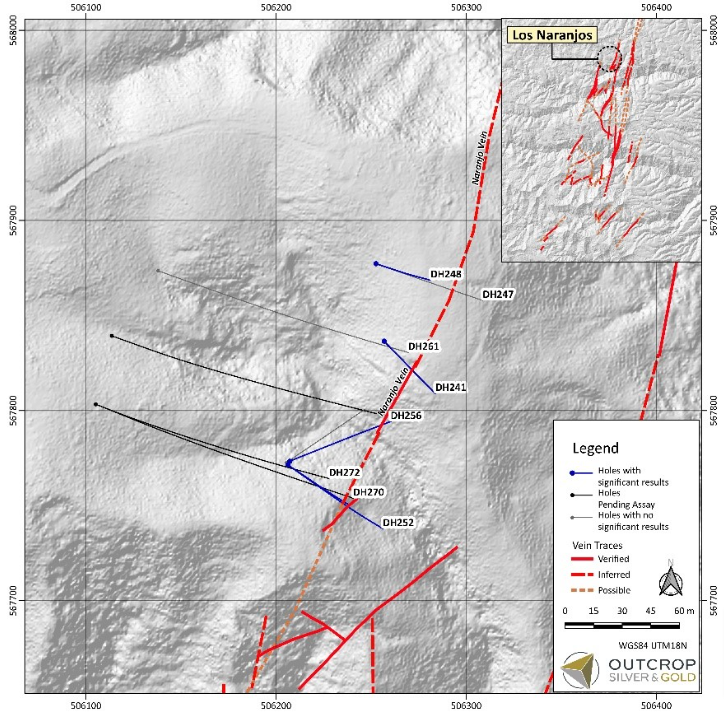

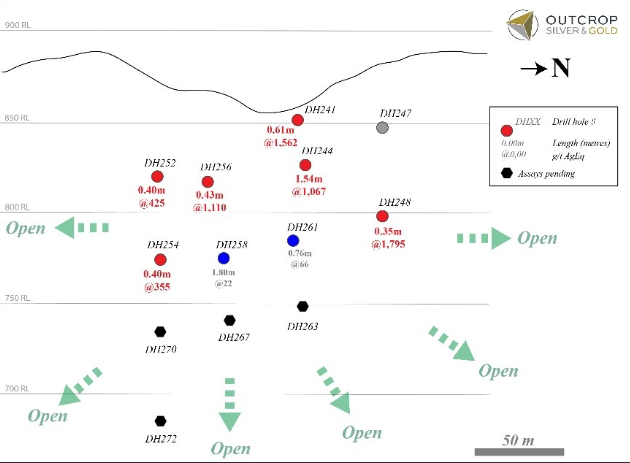

Map 1. Naranjos target area with drill hole traces.

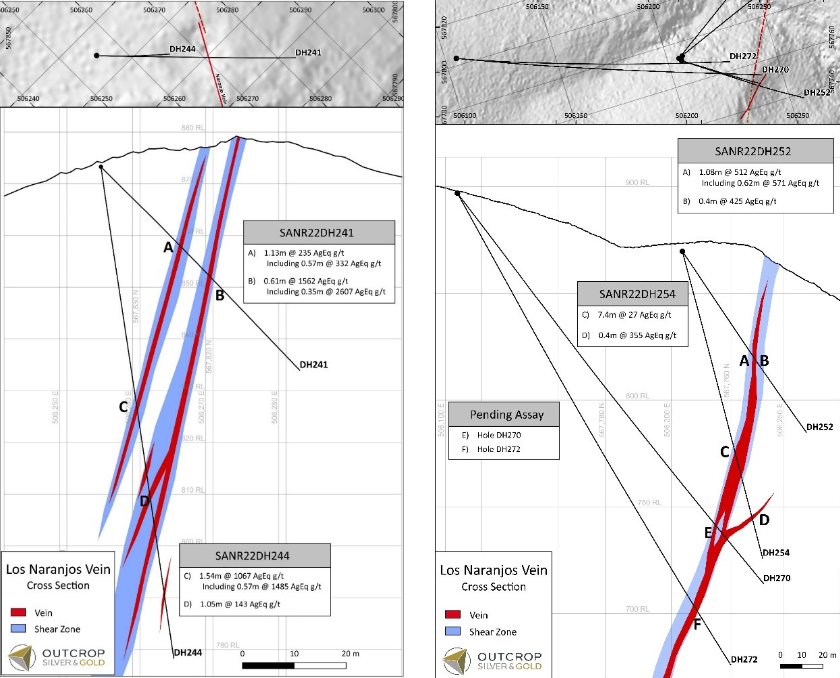

Definition drilling continues at Naranjos to the southwest and northeast and at depth. Thirteen drill holes have been completed to date. Six holes returned high-grade assays, and four holes have assays pending (Figure 3 and Figure 4). Naranjos is open in all directions with significant potential to expand its footprint of mineralization.

Figure 1. Cross sections of Naranjos target. The primary Naranjos vein is often internal or marginal to a related shear zone and zones of abundant quartz veinlets.

Figure 2. Drill core pictures showing common styles of mineralization within the Naranjos vein. Hole DH270 shows plus millimetre-scale electrum, and hole DH241 shows fine wire silver.

Map 2. Location of Naranjos target area 350 m west of the main Santa Ana vein system. At least three vein systems are projected to continue to the north, with additional high-grade shoots likely.

Figure 3: Long section of Naranjos shoot showing color-coded drill hole pierce points. Red pierce points are > 150 g eq Ag/t; gray pierce points define an assay limit of the shoot; blue pierce points are < 150 g eq Ag/t and are inferred to be low-value contours within the shoot, and not a shoot limit; deeper black pierce points show abundant coarse native electrum (Figure 4) and are pending assay. Naranjos is open in all directions.

Figure 4: Abundant coarse (up to 2 cm x 1.5 cm) electrum in deeper Naranjos drill holes pending assay. This is some of the coarsest and more abundant electrum observed in core to date. Coarse electrum generally correlates with high-grade assays.

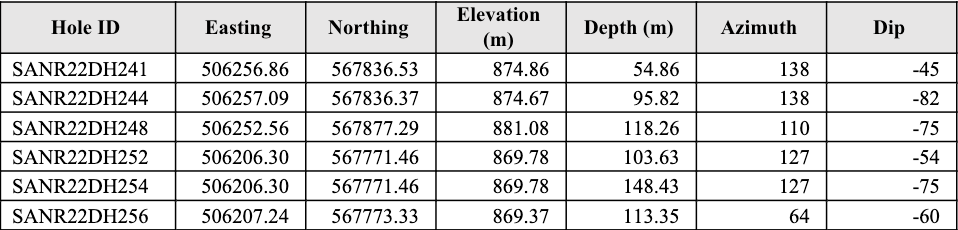

Table 2: Collar and survey table for drill hole reported in this release.

QA/QC

Core samples are sent to either Actlabs in Medellin or ALS Chemex in Medellin for preparation and then to ALS Chemex in Toronto or Lima, Peru for analysis. In line with QA/QC best practice, approximately three control samples are inserted per twenty samples (one blank, one standard and one field duplicate). The samples are analysed for gold using standard fire-assay on a 50-gram sample with a gravimetric finish. Multi-element geochemistry is determined by ICP-MS using either aqua regia (ME-MS41) or four acid (ME-MS61) digestion. Comparison to control samples and their standard deviations indicate acceptable accuracy of the assays and no detectible contamination.

About Santa Ana

The 100% owned Santa Ana project comprises 36,000 hectares located in northern Tolima Department, Colombia, 190 kilometres from Bogota. The project consists of five or more regional scale parallel vein systems across a trend 12 kilometres wide and 30 kilometres long. The Santa Ana project covers a significant part of the Mariquita District, where mining records date to at least 1585. The Mariquita District is the highest-grade primary silver district in Colombia, with historic silver grades reported to be among the highest in Latin America from dozens of mines. Historic mining depths, vein textures and fluid inclusions studies support a geologic and exploration model for composite mesothermal and epithermal vein systems having mineralization that likely extends to great depth. At Santa Ana it is unlikely that there is sharp elevation restriction common to high-grade zones in many epithermal systems with no mesozonal component. The extremely high silver and gold values on Santa Ana reflect at least three recognized overprinting mineralization events.

At the core Royal Santa Ana project, located at the northern extent of just one of the regional vein systems controlled by Outcrop, thirteen high grade shoots have been discovered – La Ivana hanging-wall and footwall (La Porfia vein system); San Antonio, Roberto Tovar, San Juan, Las Maras (Royal Santa Ana vein systems); El Dorado, La Abeja (El Dorado vein systems); Megapozo, Paraiso (El Paraiso vein system); Espiritu Santo (Aguilar vein system); La Isabela and Los Naranjos. Each zone commonly contains multiple parallel veins. The veins can show both high-grade silver and high-grade gold mineralization and low angle veins appear to connect more common high angle veins.

Outcrop drilling indicates that mineralization extends from surface or near surface to depths of at least 300 metres. Cumulatively, over 60 kilometres of mapped and inferred vein zones occur on the Santa Ana project. The Frias Mine on the south-central part of the project, 16 kilometres south of the Royal Santa Ana Mines produced 7.8 million ounces of silver post-production in the Spanish colonial era at a recovered grade of 1.3 kg Ag/t. The Frias Mine is considered an analogue to each of the eleven shoots discovered to date by Outcrop. Between the Royal Santa Ana Mines and towards the Frias Mine, veins have been extended to the south providing strong drill targets in the 4-kilometre-long Aguilar vein and El Christo veins that show high values up to 5.5 kg AgEq/t. These veins show widths up to 4.7 metres. In total 12 kilometres of vein zones have been mapped between El Dorado vein to the north and the Aguilar vein to the southeast.

About Outcrop

Outcrop is advancing exploration on five silver and gold exploration projects with world-class discovery potential in Colombia. Outcrop is currently drilling and expanding its high-grade silver-gold discovery in the Santa Ana district, Colombia. These assets are being advanced by a highly disciplined and seasoned professional team with decades of experience in Colombia.

Qualified Person

The technical information in this news release has been approved by Joseph P Hebert, a qualified person as defined in NI43-101 and President and Chief Executive Officer of Outcrop.

ON BEHALF OF THE BOARD OF DIRECTORS

|

Joseph P Hebert |

Kathy Li |

Neither the TSX Venture Exchange nor its Regulation Services Provider (as such term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “potential”, “we believe”, or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Outcrop to be materially different from those expressed or implied by such forward-looking statements or forward-looking information, including: the receipt of all necessary regulatory approvals, capital expenditures and other costs, financing and additional capital requirements, completion of due diligence, general economic, market and business conditions, new legislation, uncertainties resulting from potential delays or changes in plans, political uncertainties, and the state of the securities markets generally. Although management of Outcrop have attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Outcrop will not update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws.